-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

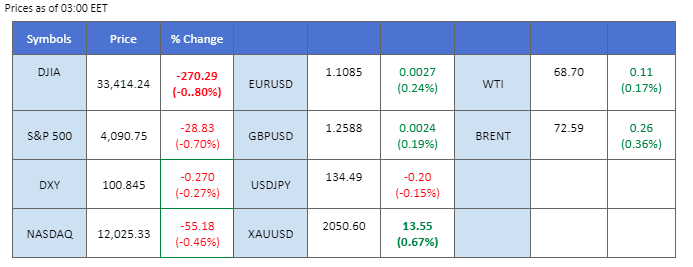

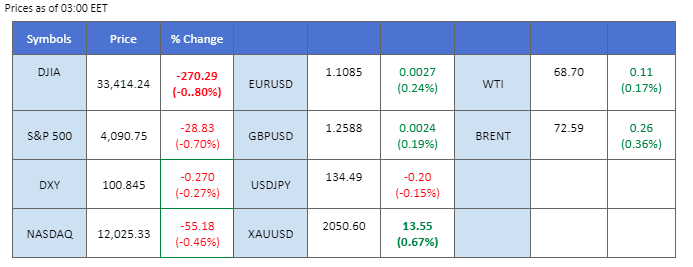

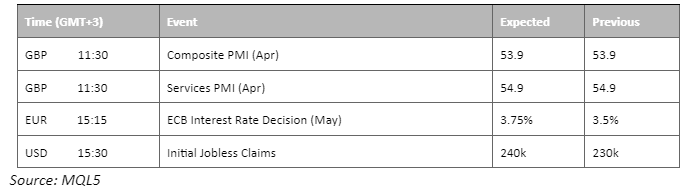

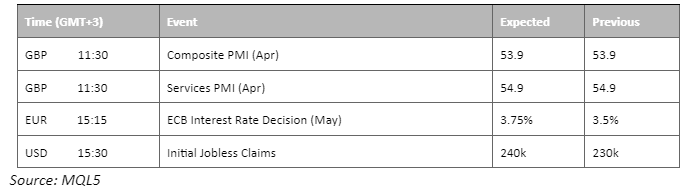

Federal Reserve Chairman Jerome Powell announced yesterday that the central bank would deliver its 10th consecutive interest-rate hike of 25 basis points, bringing the Fed rate to 5.25%, its highest level since 2007. Powell also hinted that the Fed may consider pausing the current rate hike cycle to assess whether inflation in the US is being tamed. The announcement led to a drop in the US dollar, with the dollar index falling by 0.7% and trading below $101.50. Another regional bank in the US is reportedly seeking a financial lifeline and is on the edge of collapse, worsening the banking turmoil. This, coupled with tightening credit conditions, is putting significant downward pressure on the economy, leading to a plunge in oil prices to their yearly low.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.6%) VS -25 bps (4.4%)

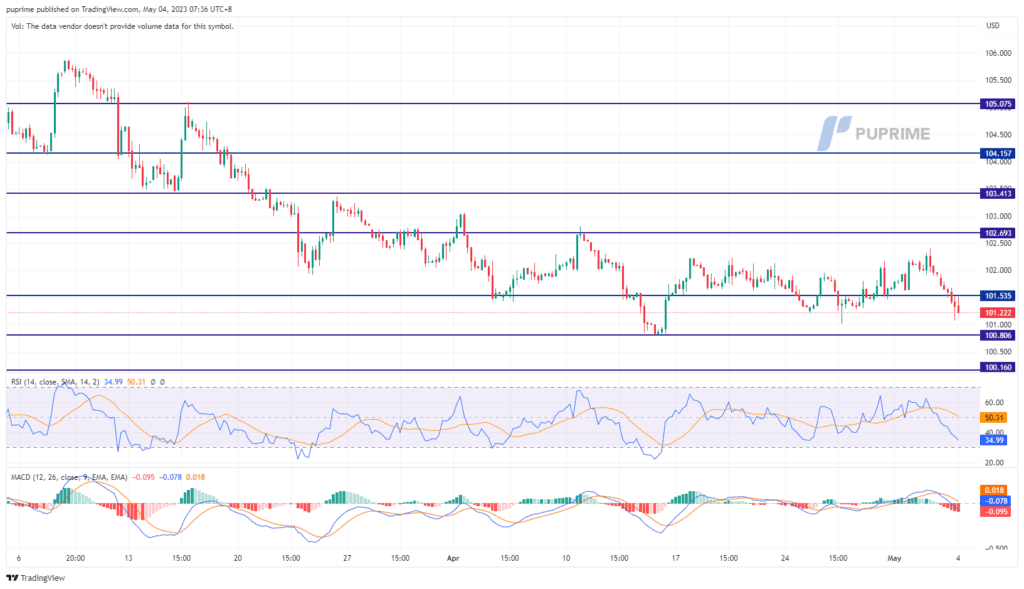

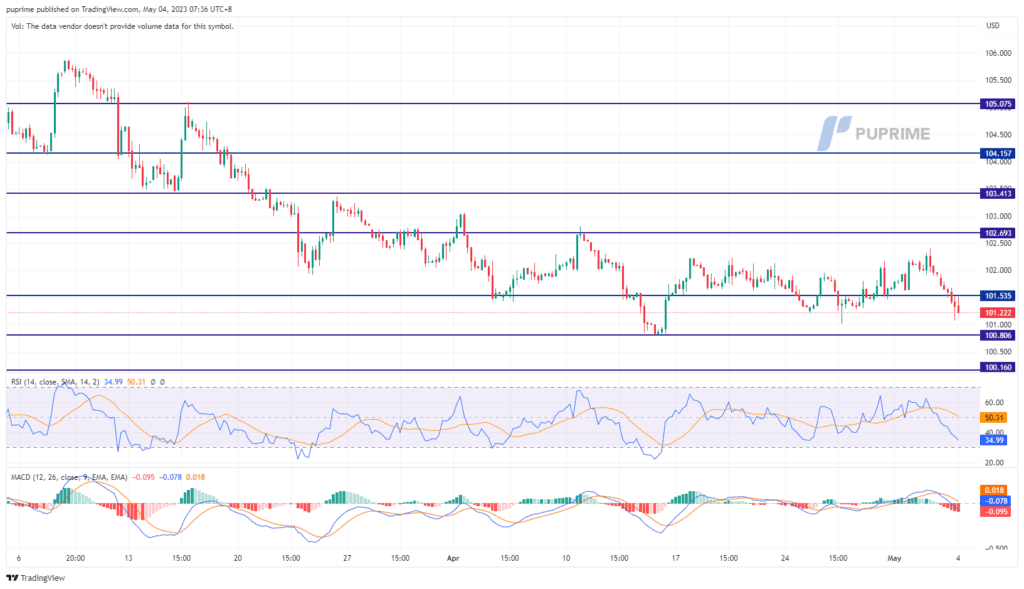

The US dollar declined on Wednesday against major currencies, with the dollar index down 0.42% to 101.42, after the Federal Reserve increased interest rates by a quarter point and signalled a possible pause in further hikes. The Fed’s decision to wait and see will give officials time to assess bank failures, political tensions over the US debt ceiling, and inflation. Although the Fed did not explicitly commit to ending its hiking cycle, it helped to lift the dollar off session lows after the central bank’s meeting statement.

The Dollar Index has dipped below $102 and is heading toward its crucial support level at $100.800. Both the RSI and the MACD suggest a bearish signal for the dollar with the RSI moving toward the oversold zone while the MACD has crossed below the zero line.

Resistance level: 101.53, 102.69

Support level: 100.80, 100.16

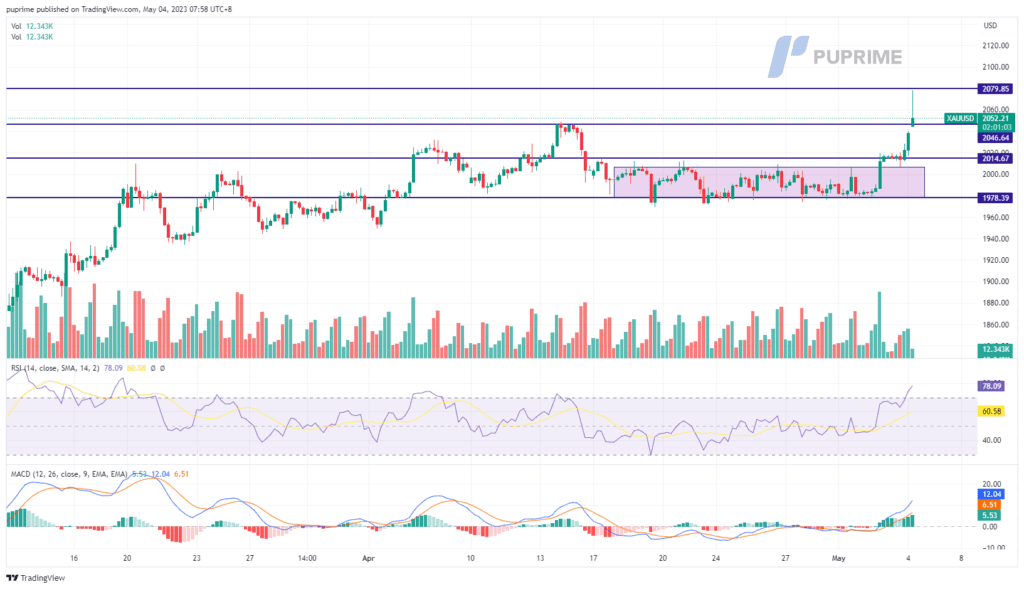

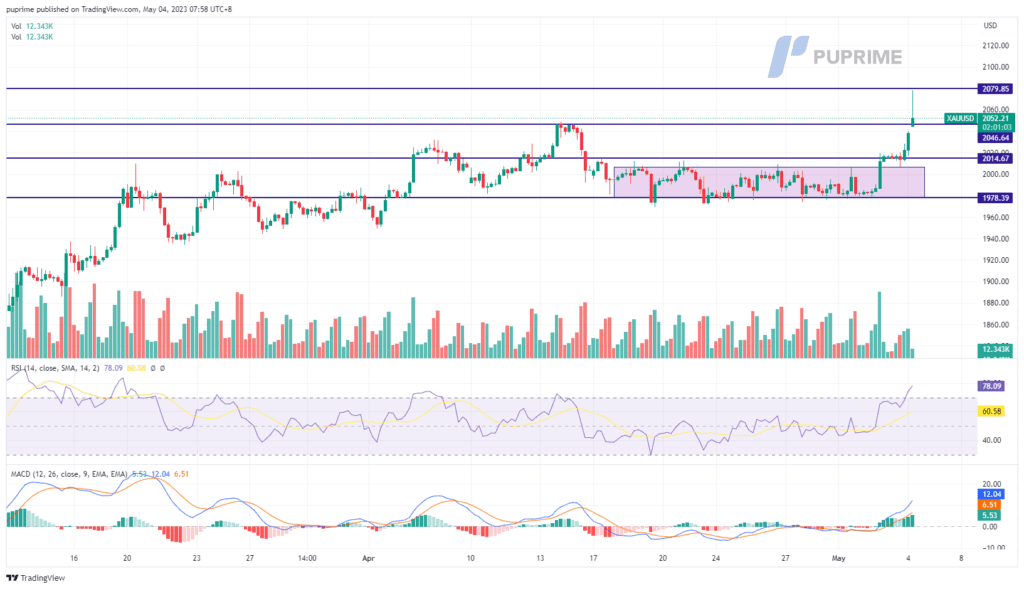

Gold prices hit its all time high at $2078.37 before its instant retrace and was traded at $2050 as of writing. The gold prices were stimulated by the interest rate decision announcement by the Fed and also hinted at a possible rate hike pause which weakened the dollar. Adding to that, the recent bank failures and also the U.S. debt ceiling issue have pushed the demand for the safe-haven asset higher. In addition, the geopolitical issue has escalated in the Russian region with the recent drone attack on the Kremlin bolstering the gold price to trade higher.

As economic concerns persist, the price of gold is expected to continue its upward trend. The indicators suggesting a strong bullish momentum for the gold prices with the RSI continue to surge in the overbought zone while the MACD diverge above the zero line.

Resistance level: 2080.00, 2100.00

Support level: 2015.00, 1978.40

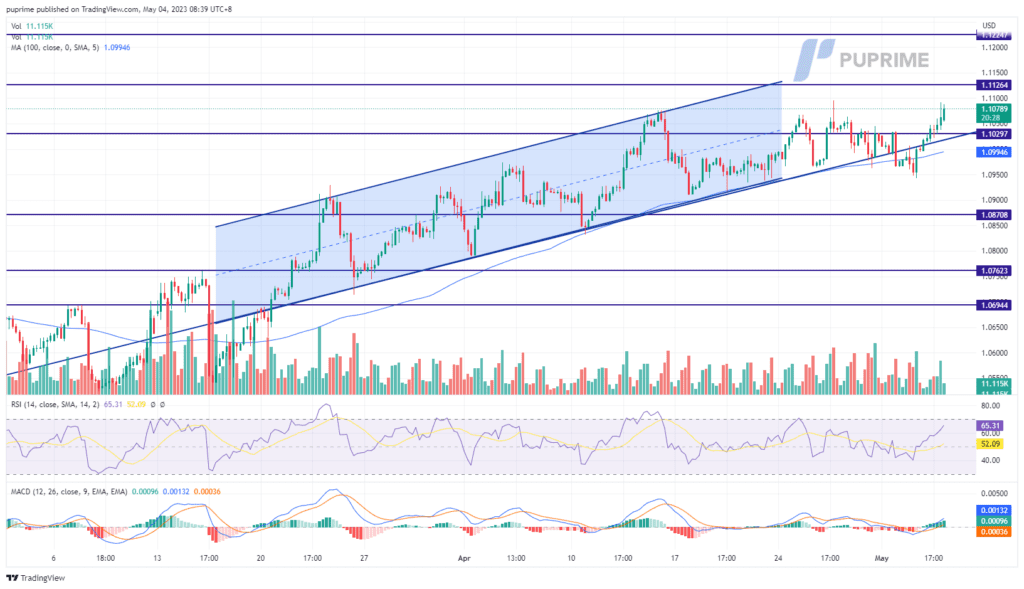

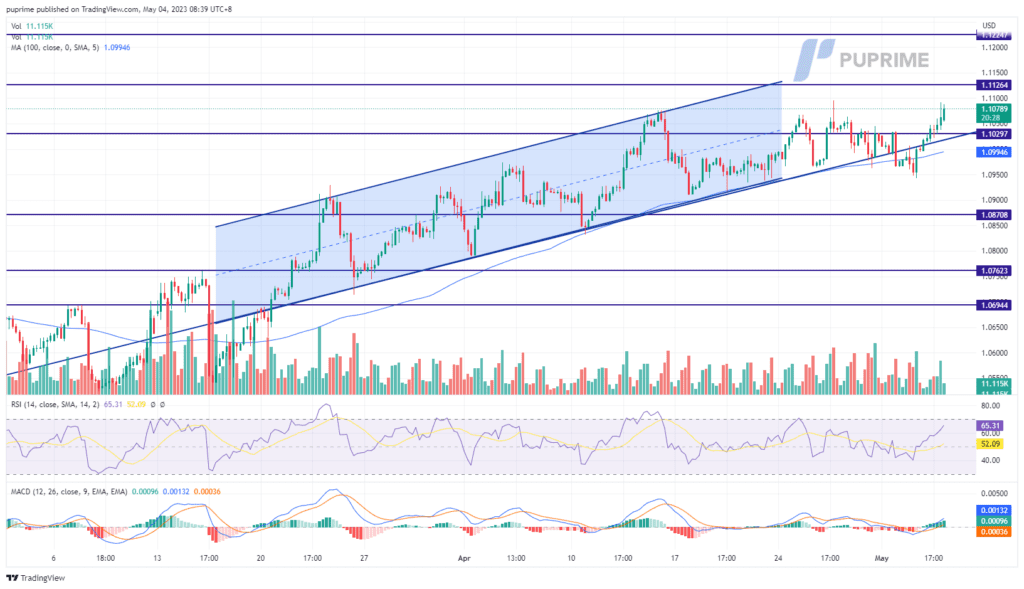

The Euro continued to be strong against the dollar as the dollar was weak against all the major currencies. The dollar continued to plunge after the interest rate announcement made by the Fed with an increase of 25 bps which is in line with the market expectation. On top of that, the bearish sentiment is stronger after Jerome Powell, the Fed’s chair, hinted at a possible pause of the current rate hike cycle. Besides, the ECB will announce its interest rate decision and the market is expecting a slowdown after 3 straight 50 bps rate hikes; any number higher than 25 bps rate hike may boost the Euro to trade higher.

The Euro has once again attempted to break through its near resistance level at 1.1070, it will be a strong bullish signal if the Euro is able to trade above the resistance level. The RSI is moving toward the overbought zone while the MACD has diverged above the zero line; suggesting the bullish momentum is gaining for the EUR/USD.

Resistance level: 1.1126, 1.1225

Support level: 1.1030, 1.0871

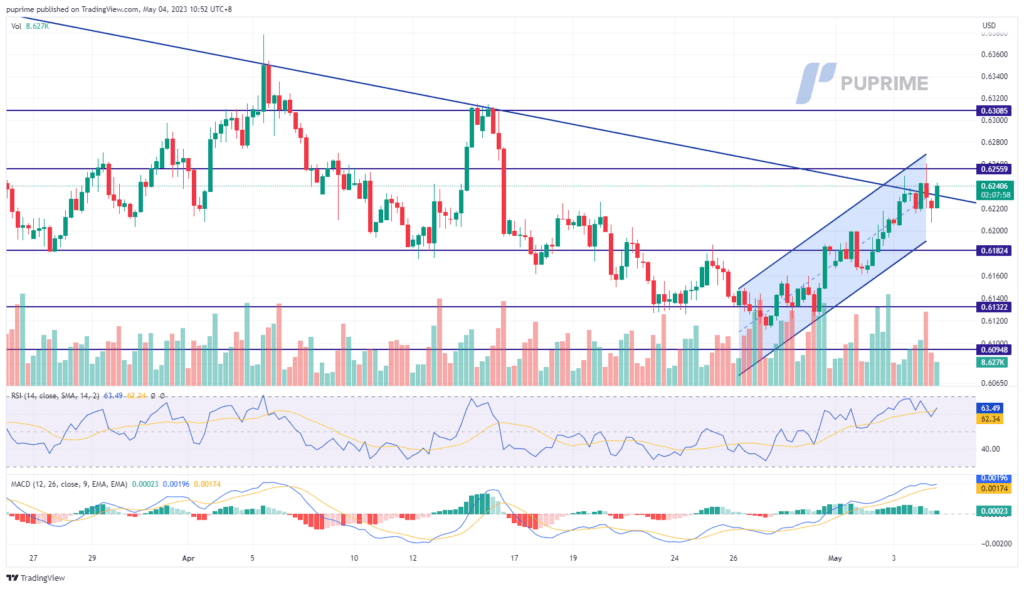

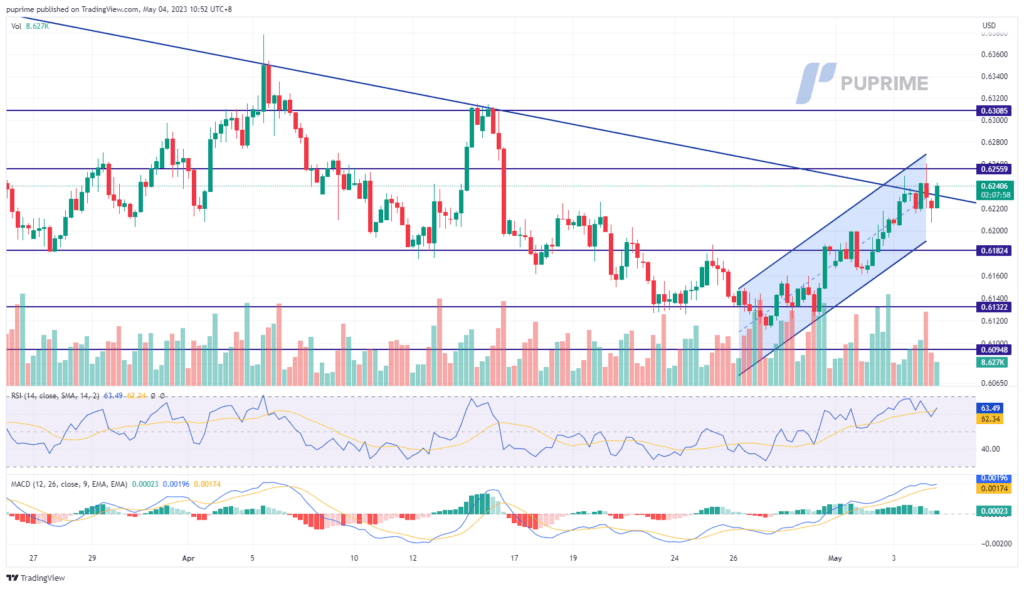

The New Zealand Dollar rebounded slightly against the weakening dollar and is still overall traded in an uptrend channel. On top of that, New Zealand unemployment held steady and the wage inflation has accelerated in the country; this prompted the chance that the Reserve Bank of New Zealand is likely to press ahead with another interest rate hike this month.

NZD/USD is trading higher following the prior rebound from the support level. The RSI and the MACD have given a bullish signal for NZD/USD with RSI breaking through the overbought zone while the MACD has been moving upward above the zero line.

Resistance level: 0.6256, 0.6309

Support level: 0.6182, 0.6132

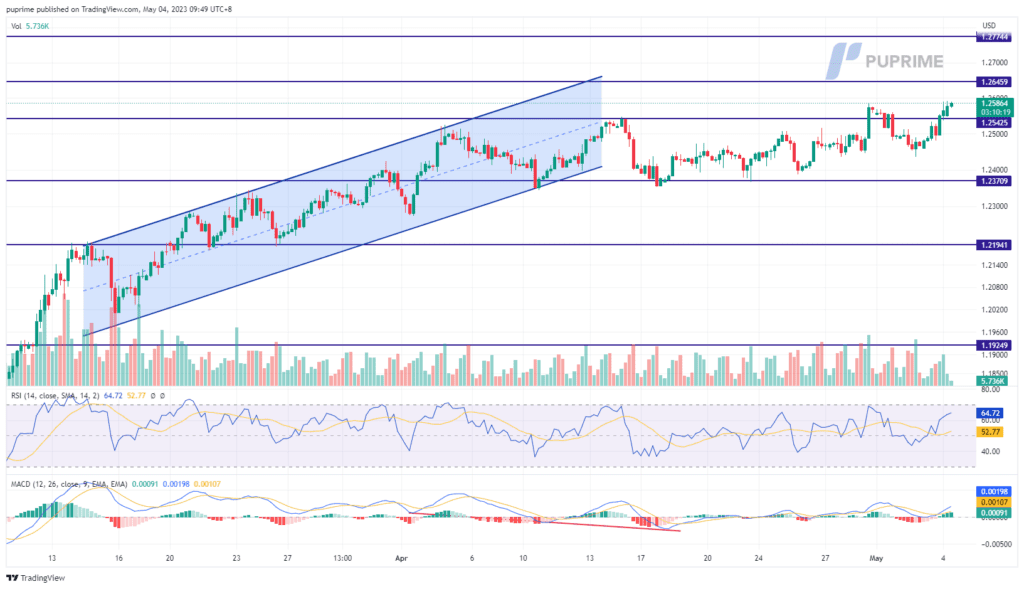

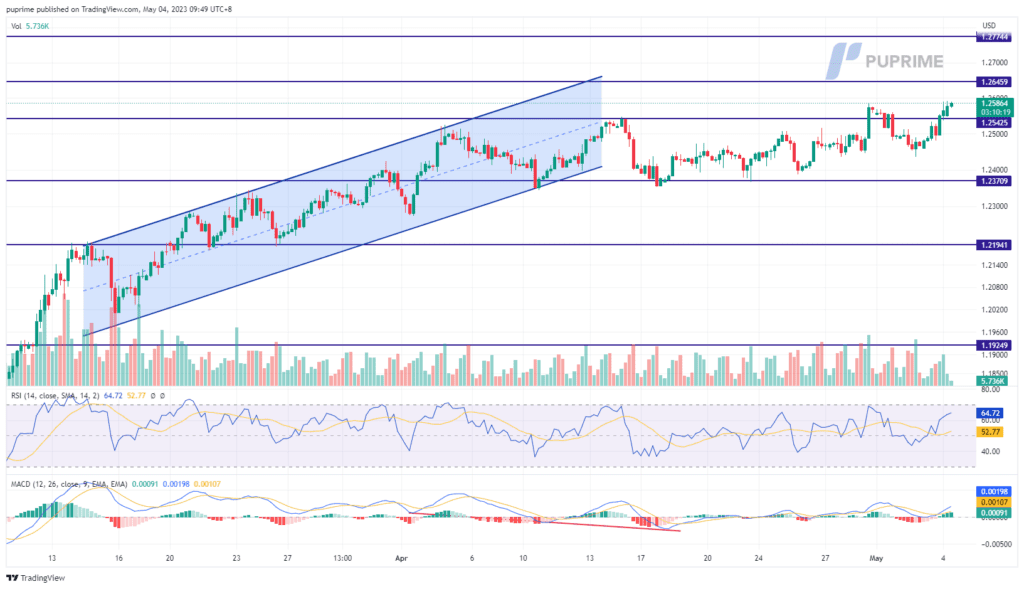

GBP/USD rebounded to its highest since last June at 1.2590 and is testing its near resistance. The Pound Sterling took advantage of a weakening dollar with the backdrop that the Fed potentially paused its current monetary tightening cycle. On the other hand, the Bank of England (BoE) is still dealing with much higher inflation than other economies that potentially raise interest rates this year. UK composite PMI reading is set to be released later today (4th May) and a higher-than-expected reading may boost the Sterling further.

GBPUSD is trading in an uptrend and potentially breaking its near resistance at 1.2590 which will be a bullish signal for GBP/USD. The RSI is moving toward the overbought zone while the MACD diverges above the zero line, suggesting the building of bullish momentum.

Resistance level: 1.2650, 1.2774

Support level: 1.2542, 1.2371

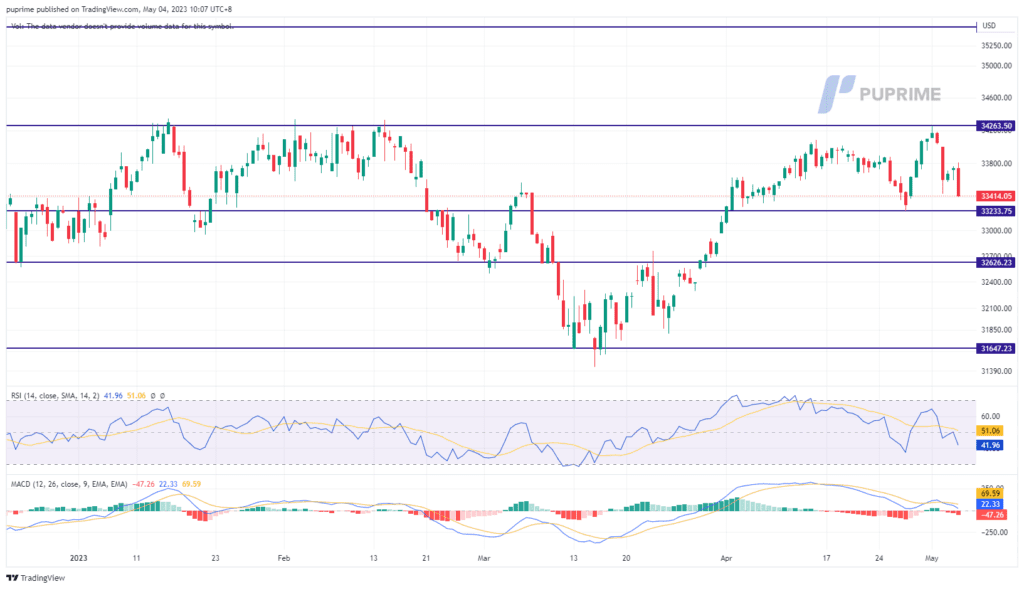

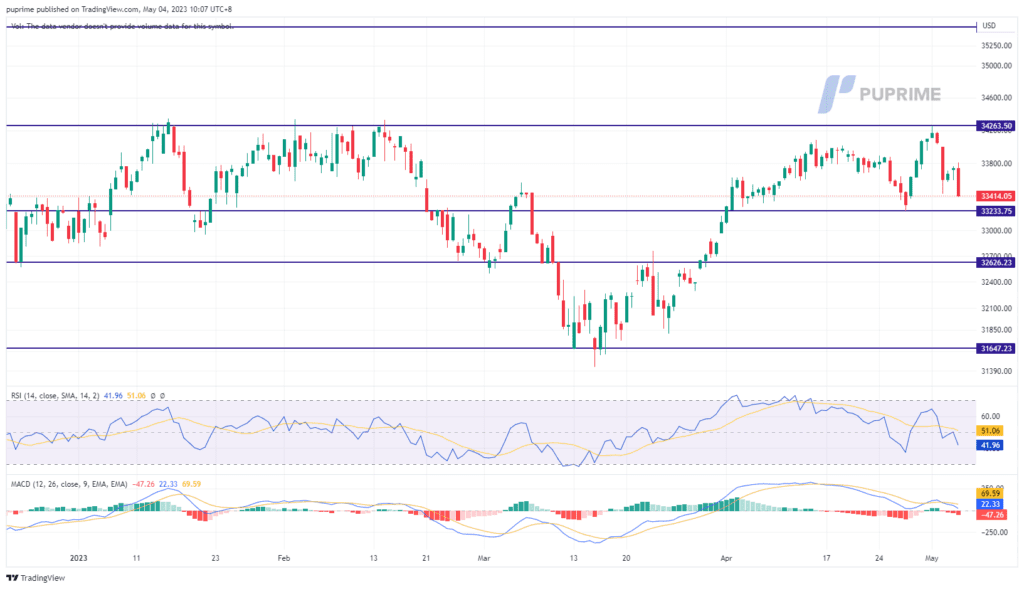

Despite the Fed announcing a rate hike, size is in line with the market expectation of 25 bps and also hinted to pause the current rate hike cycle given the upcoming data prove that the inflation is being tamed in the country. The favourable news from the Fed to the equity market failed to bolster the index to trade higher. Soon after the Jerome Powell press conference, another regional bank, PacWest share, plunged by 50% as the bank seeks a financial life line worsening the banking sector woes. The situation in the Eastern Euro region has been uneasy with the recent drone attack aimed at Kremlin pressure on the equity markets with higher risk-off sentiment escalating in the market.

The Dow is trading lower amid banking turmoil and unease geopolitical issues in the Euro. The RSI is moving toward the oversold zone while the MACD has a lower low on above the zero line suggesting the bullish momentum is diminishing.

Resistance level: 34263.00, 35486.00

Support level: 33233.00, 32626.00

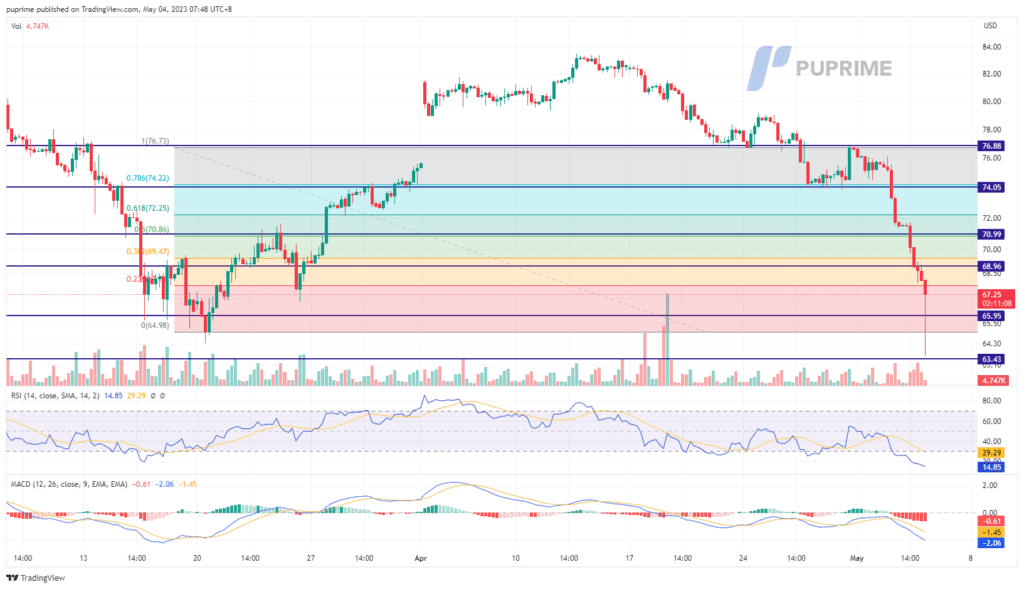

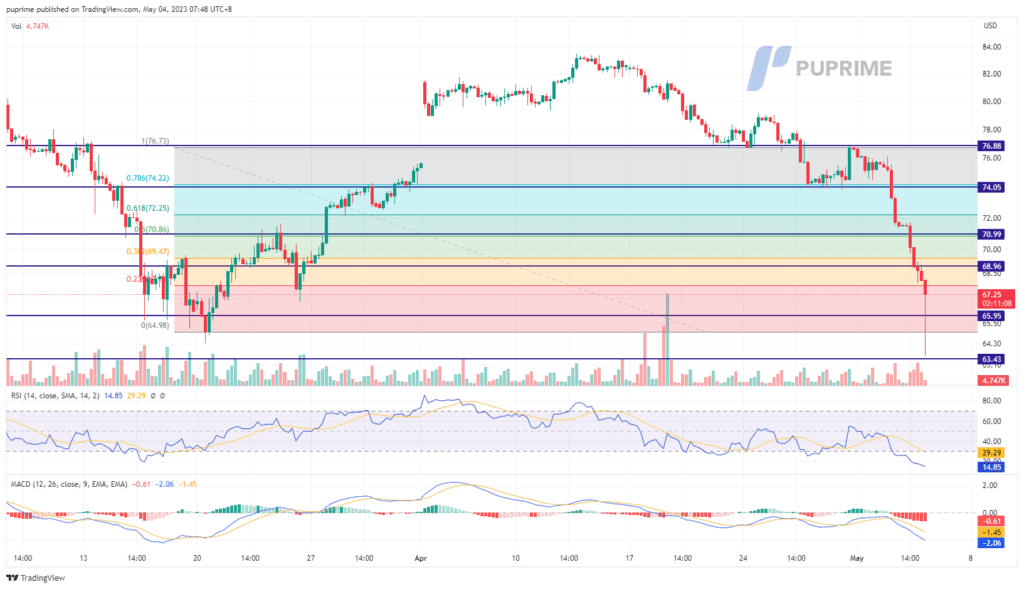

Oil prices fell 4% last night before rebound sharply afterward as the U.S. Federal Reserve raised interest rates and concerns grew about the economy. WTI fell 4.3% to $68.60 a barrel, with its session low at $67.95, the lowest since March 24. The Fed’s decision to pause further increases, along with concerns over recent bank failures, a political standoff over the U.S. debt ceiling. On the other hand, slowing manufacturing activity in China has contributed to the steep decline in oil prices.

The oil price has broken through its strong support level at $66 after the interest rate hike announcement before it quickly rebound and traded at $67 as of writing. indicators suggest a strong bearish momentum with the oil prices as the RSI hitting its lowest at 13 level while the MACD continues to diverge at the bottom.

Resistance level: 68.96, 70.99

Support level: 66.00, 63.43

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.