-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

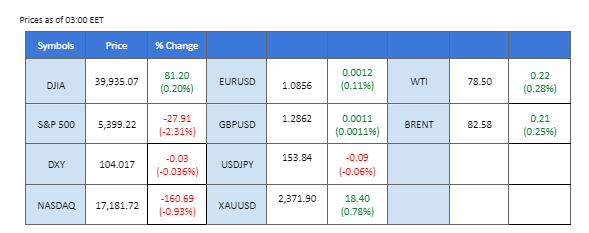

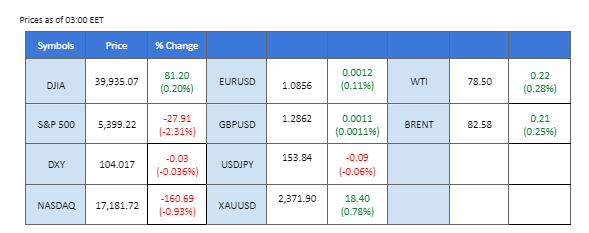

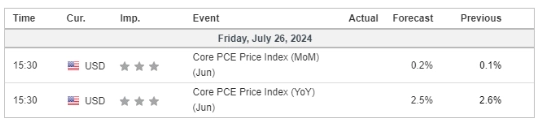

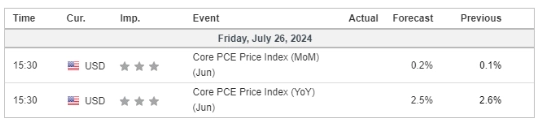

Wall Street continues to face downside risks, with the Nasdaq and S&P 500 sliding in yesterday’s session while the Dow Jones eked out a marginal gain. The small-cap Russell 2000 index remains on an upward trajectory, indicating capital rotation away from mega-cap stocks, tempered by AI jitters. The dollar index edged higher following upbeat U.S. GDP and Initial Jobless Claims data, but gains were minimal. Traders in the swap market remain optimistic about a September rate cut, which has hindered the dollar’s strength due to overwhelming Fed rate cut expectations. Traders are eyeing today’s PCE as a pivotal factor that may push for a direction for the dollar index.

In Japan, after a technical rebound against the U.S. dollar in yesterday’s market, the yen continued to strengthen. The Tokyo CPI reading came in line with market expectations, bolstering the likelihood of a rate hike from the Bank of Japan on July 31st.

In the commodity market, gold prices slid to a two-week low on the back of the strengthening dollar. The surge in yen strength has also weighed on gold prices due to the carry trade strategy in the market. Additionally, oil prices jumped by more than 1% in the last session, encouraged by upbeat U.S. economic indicators.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.3%) VS -25 bps (6.7%)

(MT4 System Time)

Source: MQL5

DOLLAR_INDX, H4

The Dollar Index has been bolstered by upbeat U.S. economic indicators, including robust GDP growth and favourable Initial Jobless Claims data, despite the high borrowing cost environment. However, persistent market optimism regarding a potential rate cut by the Federal Reserve as early as September has tempered the dollar’s strength, capping it below the 104.60 level. All eyes are now on today’s PCE reading, which is expected to be a pivotal factor in determining the direction of the Dollar Index. Should the data indicate easing inflation, it could reinforce expectations of a rate cut, potentially weakening the dollar.

The dollar index eked out a marginal gain but remained below the 104.60 mark, suggesting that selling pressure at such a level remains high. The RSI is hovering near the 50 level, while the MACD is flowing closely toward the zero line, with both indicators giving a neutral signal for the index.

Resistance level: 104.45, 104.75

Support level: 104.05, 103.65

Gold prices have continued to face headwinds, tumbling to a two-week low following the release of upbeat U.S. economic data. The dollar’s strength has undermined gold, while persistent selling pressure has been exacerbated by the strengthening of the yen, which has negatively impacted gold’s carry trade. Today’s U.S. PCE reading could be a pivotal factor for a potential technical rebound in gold prices, as it may influence market sentiment regarding the dollar and overall inflationary trends.

Gold prices have retreated and come to their previous liquidity zone at near the 2360 level. The RSI is dipping into the oversold zone, while the MACD edged lower from below the zero line, suggesting that the bearish momentum remains strong with the precious metal.

Resistance level: 2368.00, 2388.00

Support level: 2347.00, 2321.00

GBP/USD extended its losses as market participants anticipated that the Bank of England (BoE) might consider a rate cut next week, weighing on Pound demand. With expectations that the Fed might maintain interest rates and the BoE might cut rates, the rate differential between the US and UK continues to exert pressure on the Pound Sterling.

GBP/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the pair might experience technical correction since the RSI entered the oversold territory.

Resistance level: 1.2935, 1.2995

Support level: 1.2855, 1.2785

EUR/USD movement remains consolidated due to a lack of market catalysts from the Eurozone. Today, the pair’s trend is likely to be USD-centric, focusing on the US Personal Consumption Expenditures (PCE) Price Index inflation. Market expectations are for Core PCE inflation to tick down to 2.5% in June from 2.6% previously. Euro traders will need to wait for next week’s pan-EU Gross Domestic Product (GDP) update and the latest Fed rate decision next Wednesday for further direction

EUR/USD is trading flat while currently hovering around the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the pair might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 1.0875, 1.0940

Support level: 1.0795, 1.0745

The Nasdaq extended its losses as recent downbeat financial results continued to weigh on the US equity market. Alphabet Inc. (Google) has been a significant drag on Nasdaq. Despite economic growth accelerating more than forecast in the second quarter, with GDP increasing at a 2.8% annualised rate after a 1.4% rise in the previous quarter, concerns over higher borrowing costs persist. The US equity market may continue to experience volatility, particularly after the release of the crucial US Core PCE Price Index.

Nasdaq is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 18975.00, 20015.00

Support level: 18215.00, 17115.00

The Japanese yen has strengthened against the U.S. dollar by nearly 5% this week, with bearish momentum for the USD/JPY pair remaining strong. The pair took a breather from its decline as U.S. economic indicators released last night triggered a technical rebound. However, the Tokyo Core CPI reading, released during the Sydney session today, came in line with market expectations at 2%. This bolstered the chances for the Bank of Japan to raise interest rates on July 31st, further boosting the yen’s strength.

USD/JPY had a technical rebound in the last session but remained trading with its downtrend trajectory. The RSI remained below the 50 level while the MACD stayed at its recent low level, suggesting the bearish momentum is overwhelming with the pair.

Resistance level: 154.60, 155.80

Support level: 152.85, 151.70

Crude oil prices rebounded from their two-month low, catalysed by upbeat U.S. economic data released last night, which suggests that the U.S. economy remains resilient and has bolstered the demand outlook for oil. However, concerns over China’s shaky economic performance continue to weigh on oil prices, limiting their strength despite the positive U.S. indicators.

Oil prices have rebounded and climbed to above the Fibonacci Retracement level of 61.8%, suggesting a potential trend reversal for oil. The RSI has also rebounded from the oversold zone, while the MACD has crossed and edged higher, suggesting the bearish momentum has eased.

Resistance level: 79.70, 81.40

Support level: 77.00, 75.05

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.