-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

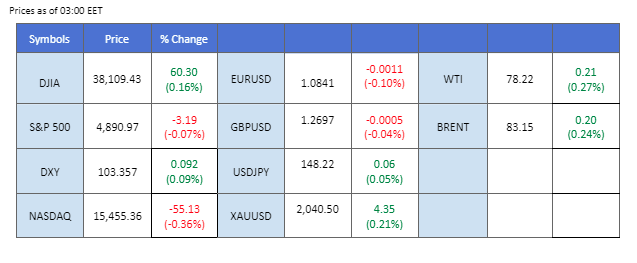

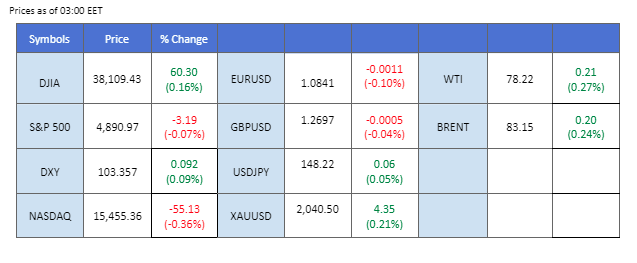

The Federal Reserve’s preferred inflation gauge, the PCE reading, revealed last Friday, contributed to a decline in the strength of the dollar. The inflation data, aligning with market expectations at 2.6%, suggests that pricing pressures in the U.S. are moderating. Investors are eagerly anticipating the release of the Federal Open Market Committee (FOMC) meeting minutes on Thursday to gain insights into the Fed’s prospective monetary policy moves, providing a key determinant for the dollar’s strength. Simultaneously, the euro’s GDP data, scheduled for tomorrow (30th Jan), is poised to exert a direct influence on the euro’s strength. Furthermore, oil prices are sustaining their rally, reaching the highest levels in nearly two months. This upward trajectory can be attributed to heightened geopolitical tensions in the region, marked by an Iran-backed militant attack on U.S. troops in Jordan and an incident involving a fuel tanker in the Red Sea, escalating concerns and thereby stimulating oil prices.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The US Dollar faced initial headwinds following a lacklustre inflation report, adding complexity to the Federal Reserve’s monetary stance. The US Core PCE Price Index dipped from 3.2% to 2.90%, missing market expectations at 3.0%. Despite this, market participants are sceptical of an imminent rate cut in March, given recent positive economic growth. Probabilities have dropped to 47%, down from 80% just two weeks ago. All eyes are on the Federal Reserve’s statements this week for insights into future monetary policy.

The Dollar Index is trading flat while currently near the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the index might trade higher as technical correction since the RSI stays above the midline.

Resistance level: 103.90, 104.65

Support level: 103.15, 102.20

Gold prices surged from crucial support levels, fueled by disappointing inflation figures that reduce the likelihood of an early March rate cut by the Federal Reserve. Geopolitical tensions in the Middle East, with a drone attack on US forces in Jordan, add further uncertainty, supporting gold’s safe-haven appeal.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2035.00, 2055.00

Support level: 2019.00, 1985.00

The GBP/USD pair exhibited a relatively sideways trend in anticipation of two pivotal central bank decisions: the Bank of England (BoE) interest rate decision and the Federal Open Market Committee (FOMC) interest rate decision, both scheduled for Thursday. Market sentiment widely anticipates that both central banks will opt to maintain their current interest rate levels. This cautious approach is perceived as an effort to manage inflationary pressures while avoiding the risk of entering into a recessionary environment. Traders and investors closely monitor these decisions for potential impacts on currency dynamics.

GBPUSD is traded sideways and has a lower high price pattern, suggesting the bullish momentum is waning. The RSI has been flowing flat near the 50 level while the MACD is on the brink of breaking below the zero line, suggesting an easing in bullish momentum.

Resistance level: 1.2785, 1.2815

Support level: 1.2610, 1.2530

The Euro is presently trading near its recent low, hovering around the 1.0840 level, as the market awaits catalysts for the EUR/USD to establish a clear direction. Tomorrow’s (30th Jan) release of Eurozone GDP figures is anticipated to wield a direct impact on the Euro’s strength. Additionally, traders are closely monitoring the upcoming Federal Open Market Committee (FOMC) interest rate decision scheduled for announcement on Thursday. These events are poised to play a pivotal role in determining the trajectory of the EUR/USD pair.

The EUR/USD pair recorded a lower high price pattern but has found support near the 1.0840 level. The RSI is moving downward while the MACD hovering close to the zero line suggests a bearish momentum is forming.

Resistance level: 1.0866, 1.0954

Support level: 1.0775, 1.0700

The US equity market experienced a slight retreat attributed to technical correction and profit-taking ahead of mega-cap earnings reports and the Federal Reserve’s rate policy decisions. Encouraging economic data, including robust Q4 growth and lower-than-expected core inflation, provided resilience. Investors keenly await further quarterly earnings reports, including those from Boeing and Merck.

Dow Jones is trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36600.00

The Japanese Yen is experiencing a decline in strength against its counterparts, notably influenced by recent readings of the Bank of Japan (BoJ) Core Consumer Price Index (CPI) and the Tokyo Core CPI. These readings indicate a softening in inflation within the country. The BoJ is evidently seeking compelling evidence of sustainable inflation before considering a significant departure from its long-standing ultra-loose monetary policy. Market participants are also closely monitoring the Federal Open Market Committee (FOMC) interest rate decision, as it is expected to have implications for the price movement of the pair.

The pair is approaching its recent high as the Japanese Yen trades softly. The RSI is flowing near the 50-level while the MACD has declined to near the zero line, suggesting the bullish momentum is easing.

Resistance level: 148.67, 151.76

Support level: 146.76, 145.21

The AUD/USD pair appears to have mitigated its bearish momentum and is presently engaged in sideways trading, situated above its liquidity zone. Upcoming economic events are expected to influence the pair’s price dynamics. Specifically, the release of Australian Retail Sales data scheduled for tomorrow and the GDP data set to be announced on Wednesday are anticipated to have a notable impact on the AUD/USD pair.

The pair is trading sideways above its liquidity zone, awaiting a catalyst to pick a direction for the pair. The RSI remains flat while the MACD flows closely along the zero line, giving a neutral signal for the pair.

Resistance level: 0.6617, 0.6712

Support level: 0.6510, 0.6499

Crude oil prices continue to climb on supply concerns after a drone attack on a Trafigura-operated fuel tanker in the Red Sea. Russian refined product exports are set to fall due to refinery repairs post-drone attacks. The upcoming OPEC+ meeting on 1st February will be a crucial catalyst for the oil market.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 77, suggesting the commodity might enter overbought territory.

Resistance level: 78.65, 80.00

Support level: 75.20, 70.25

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.