PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

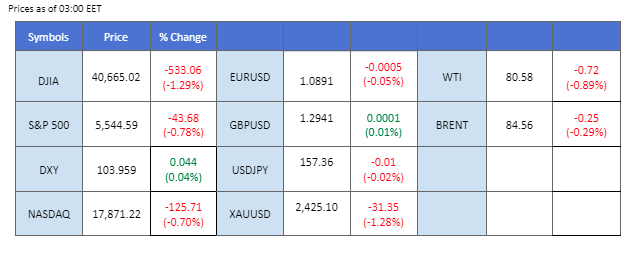

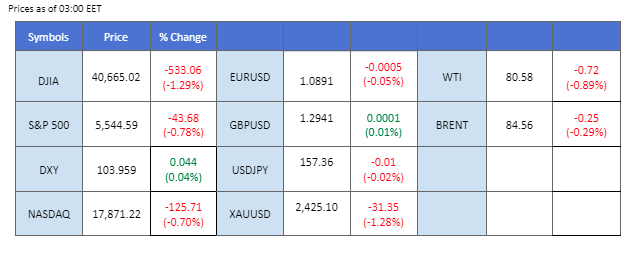

The U.S. job data released yesterday bolstered speculation of a September Fed rate cut. Initial Jobless Claims saw the biggest increase since May, suggesting the labor market in the U.S. is easing, and inflation is cooling as a result. Despite this, the dollar took a breather from its downtrend and found footing near the $104 mark, while the equity market was weighed down by the Biden Administration’s potential trade restrictions on China, closing lower.

Meanwhile, the euro eased in strength after the ECB’s interest rate decision aligned with market expectations, holding the borrowing cost unchanged. However, the European Central Bank expressed concerns that the inflation rate in the region will remain above its target throughout 2024, creating uncertainty about future ECB monetary policy moves.

Gold prices slid nearly 2% from their peak this week as risk-off sentiment dominated the market, coupled with profit-taking that dragged down the precious metal’s upward momentum. Conversely, oil prices traded in a lacklustre manner, lacking any significant catalyst.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool0 bps (93.3%) VS -25 bps (6.7%)

(MT4 System Time)

N/A

Source: MQL5

The Dollar Index, which tracks the US dollar against a basket of six major currencies, rebounded slightly following better-than-expected manufacturing data from the United States. The US Philadelphia Fed Manufacturing Index surged from 1.3 to 13.9, far exceeding the expected 2.7. This marked the highest level in over two years, indicating a positive economic outlook. Coupled with a robust retail sales report, this strong economic performance may shift investors’ perspectives on the US economy. However, gains were limited by a downbeat jobs report, with US Initial Jobless Claims rising to 243K, slightly worse than the expected 229K.

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 103.80, 104.20

Support level: 103.20, 102.80

Gold prices dipped due to profit-taking and technical correction after the release of better-than-expected US manufacturing data. The dollar’s slight rebound also weighed on dollar-denominated gold. Investors have largely digested the recent news of a potential assassination attempt on Trump, with expectations that US political issues might stabilise. However, uncertainties remain, including potential risks in the market and possible Federal Reserve rate cuts. Investors should continue to monitor these developments for further trading signals.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2440.00, 2455.00

Support level: 2420.00, 2390.00

The GBP/USD pair took a breather from its uptrend movement and slid by 0.5% in the last session. The downside pressure is likely due to the high unemployment rate recorded in the UK, which may prompt the Bank of England to adopt a monetary easing policy to mitigate the situation. Meanwhile, Pound Sterling traders are eyeing today’s UK Retail Sales data, which could serve as a catalyst for the Pound Sterling to regain its strength.

The GBP/USD pair has lost its bullish momentum and retreated from its one-year high at 1.3044. The RSI has dipped from the overbought zone, while the MACD edged lower toward the zero line, suggesting that the bullish momentum is easing.

Resistance level: 1.2990, 1.3065

Support level: 1.2850, 1.2760

The euro dipped after the European Central Bank (ECB) left interest rates unchanged at 3.75%, following June’s landmark cuts. The decision was widely expected due to ongoing concerns over inflationary pressures, particularly from the labor market. The ECB noted that Eurozone headline inflation dipped to 2.50% in June from 2.60%, though this was still slightly higher than expected. Investors now anticipate possible rate cuts in September but will continue to monitor economic performance for further guidance.

EUR/USD is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.0940, 1.0995

Support level: 1.0875, 1.0795

The Dow edged higher in the early session, breaking its all-time high, before quickly retracting by more than 500 points later in the day. The index faced strong selling pressure as stock rotation persisted, with the likelihood of a September rate hike bolstered by the downbeat job data. Meanwhile, with the U.S. presidential election approaching, both candidates are expected to propose more severe trade restrictions with China as part of their manifestos, contributing to uncertainty in the equity market.

The Dow traded significantly lower from its peak while it is still at above 38.2% of the Fibonacci retracement level, suggesting the Dow remains in its uptrend trajectory. The RSI has dropped out from the overbought zone while the MACD has crossed on the above, suggesting the bullish momentum has eased.

Resistance level: 40930.00, 41300.00

Support level: 40640.00, 40380.00

The USD/CHF pair found support near the 0.8840 level and recorded a technical rebound. The dollar regained strength in the last session, which was the main factor driving the pair higher. Meanwhile, Switzerland’s June trade balance improved to over 6 billion CHF, potentially exerting downside pressure on the pair as the CHF strengthens.

The USD/CHF performed a technical rebound from its recent low at 0.8840 but remained below the Fibonacci retracement of 61.8%, suggesting that the pair will continue trading within its downtrend trajectory. The RSI has rebounded while the MACD has crossed at the bottom, suggesting the bearish momentum is easing.

Resistance level: 0.8915, 0.8940

Support level: 0.8835, 0.8780

The USD/JPY pair rebounded from its recent low and approached its key liquidity zone near the 157.65 level. This rebound was primarily driven by a technical recovery in the dollar. However, the dollar’s strength remains under pressure due to downbeat U.S. economic indicators and heightened speculation about a Fed rate cut. Additionally, Japan’s National CPI reading came in at 2.6%, slightly improved from the previous reading but below market expectations, casting uncertainty on the Bank of Japan’s interest rate decision at the end of the month.

The pair has reached the key liquidity zone. A break above this level will break the downward structure of the price movement, which may serve as a bullish signal for the pair. The RSI edged higher, while the MACD crossed at the bottom, suggesting the bearish momentum has eased.

Resistance level: 158.25, 158.90

Support level: 156.60, 155.80

Crude oil prices retreated as the strengthening US dollar reduced the appeal of dollar-denominated oil. Pessimistic economic performance in China, the world’s largest crude oil importer, also contributed to the decline. Chinese leaders signalled a steady economic policy course, but provided few concrete details, further weighing on prices.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 81.35, 82.90

Support level: 79.70, 78.30

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.